Deckers Brands: Unveiling the Magic Behind UGG Boots and Hoka Shoes

It took 45 years to smash through the US$2 billion revenue mark and now it already has the US$5 billion figure in its sights.

Hello guys, welcome to the first English Edition of this newsletter, for those who don’t know me, you can call me Snowballer, I mostly write about business and investing in my native language (Portuguese), but I am always trying to evolve so I decided to write in English too after many friends and readers asked, let’s see how this will go.

This first edition is about Deckers Brands, one of the best performing stocks this year non-related to artificial intelligence.

Deckers's story is fascinating and not enough people know about it. The fact that it's been around since 1973 and is still growing makes it more fascinating for me.

If you have any pushback, comments, or questions I encourage you to reach out. You can comment below, find me on Twitter or reach by email at marketing.snowballer@gmail.com

In a world where fashion trends come and go, there are certain brands that leave an indelible mark, captivating our hearts and securing a permanent place in our closets.

Among these iconic names, one stands tall, encompassing unparalleled comfort, style, and quality: Deckers Brands.

From the cozy warmth of UGG boots to the edgy appeal of Hoka shoes, this powerhouse of footwear has revolutionized the way we step into style.

So, whether you're seeking the ultimate winter companion or striving for a sporty statement, prepare to immerse yourself in the enchanting world of Deckers Brands—a fashion journey that will leave you longing for every step you take.

Born from a passion for surf, sand and adventure in California’s sun-kissed Santa Barbara, Deckers Brands’ journey began with the launch of a simple flip-flop.

Co-founders Doug Otto and Karl Lopker began selling them in the early 1970s, mostly to surfers who wanted flashier sandals for the beach.

The duo, with Otto handling sales and distribution while Lopker oversaw manufacturing, based the company on durable, long-lasting sandals which catered to the surf community.

After buying out Lopker in 1982, Otto decided to license and manufacture other companies' product which resulted in a 1985 agreement with Teva.

In the nearly 40 years since then, it has grown its stable to include five brands with customers all around the world and looks set to deliver a record US$5.2 billion in revenue this year.

In 1977, a bored accountant named Brian Smith moved from Australia to California in hopes of a more exciting life. When he arrived, Smith was surprised to see America's beaches weren't inundated with the sheepskin-lined booties every self-respecting Australian surfer slips their wet feet into after a day of riding waves.

There is some debate over which Australian surfer was first to take ugg boots to the west coast of America, Brian Smith or Shane Steadman; nevertheless, there is evidence that ugg boots were being imported from Australia and sold in California during this period.

Brian Smith imported batches of Australian ugg boots to California in 1978, where he found mainstream shoe stores were not interested; however, Californian surfers and snowboarders enthusiastically adopted uggs for après surf and après ski.

Subsequently, he trademarked UGG, and Ugg Holdings became the first company to successfully import this product into the United States (Jackson 2001).

He secured $20,000 from investors to create a couple thousand prototypes and execute a marketing strategy. He took his footwear to small surf shops in San Diego, Santa Monica, and Orange County, and while local surfers praised the shoes, he was barely able to move any inventory.

"It took us several years to get rid of that first 2,000 pairs," Smith told the San Diego Daily Transcript. "[Buyers] didn't even understand what the product was. They didn't even perceive it as footwear."

The profile of Ugg boots in the United States during the 1980s remained niche, but were recognized as ‘cool’ through their connection with surfing and snowboarding culture, and Brian Smith listed Robert Redford as one of his early US customers .

The development of the American (and international) profile of ugg boots gained momentum during the 1990s.

In 1994, there were two significant moments when ugg boots were in the media spotlight. The first was when Pamela Anderson was photographed on the set of Baywatch in her signature red swimsuit wearing Ugg boots.

This event exposed Ugg boots to a broader audience and positioned these sheepskin boots both in popular culture and the sporting arena, driving the perception and discourse of the Ugg boot further away from its Australian origins.

The tipping point for the brand came in 1994, when the US Olympic team wore Ugg boots during the opening ceremony in Lillehammer, Norway.

According to Adheer Bahulkar, a retail strategist at management consulting firm A.T. Kearney, this gave Ugg a huge boost in sales and name recognition.

"Shoppers scrambled to buy the boots after seeing them on the Olympic team, and the brand saw double-digit growth," he explains.

Otto became fast friends with Brian Smith, often seeing each other in surfing shops. The two swapped stories and helped each other on the road, aware that their products held the key to two distinctive seasons. While Deckers thrived in the summer months, UGG reigned supreme in the winter.

It soon became an ongoing joke that one should buy the other out – although what started out as a joke soon became reality when Otto ultimately decided to take the leap. A year later, Smith would sell his brand to Deckers Outdoor Corporation, for $14.6 million.

In 2000, American TV personality Oprah Winfrey helped to raise the profile of ugg boots further into the mainstream internationally. She endorsed ugg boots by showcasing them on the ‘Favourite Things’ segment of her TV show and bought pairs of Uggs for her entire team and the studio audience.

Deckers Brands now includes UGG, Teva, Sanuk, HOKA and Koolaburra by UGG, and is a global corporation with almost 4,000 employees. Its foot is clearly firmly on the gas.

It took 45 years to smash through the US$2 billion revenue mark and now it already has the US$5 billion figure in its sights.

When Dave Powers was named chief in 2016, Deckers was known for boots and sandals but not much more. Ugg was doing over $1.5 billion a year in sales. Hoka, a fledgling line of sneakers with jumbo foam soles, wasn’t yet doing $100 million, making it a niche brand like the company’s Teva sandals.

Powers worked to establish Hoka’s credentials with runners while using Ugg’s heft to get the brand more shelf space. Next came uptake from celebrities —Britney Spears tweeted a pic of her Hokas in 2017—followed by fashionistas, and finally the sore-footed masses seeking comfort and cool.

Last year, Hoka, now available as runners, loungers, and trail shoes, smashed through $1 billion in sales. Within two years, the brand is expected to do $2 billion.

Deckers shares are up more than 800% under Powers. The company has nearly doubled its operating margins and shifted to more direct sales, from 34% of revenue to 40%. Powers says that direct sales remain a priority and that he can get them to 50%.

The past five years have been about turning things around in terms of business optimization and improving profit margins, but the focus has now switched.

“We’re now entering a pretty serious growth phase – where we’re really focused on driving best-in-class revenue growth and best-in-class operating margins” Dave says.

“From a strategic focus perspective, the area that we’re really focusing on in the next 18–24 months is continuing to maintain that momentum globally with a real focus on international.

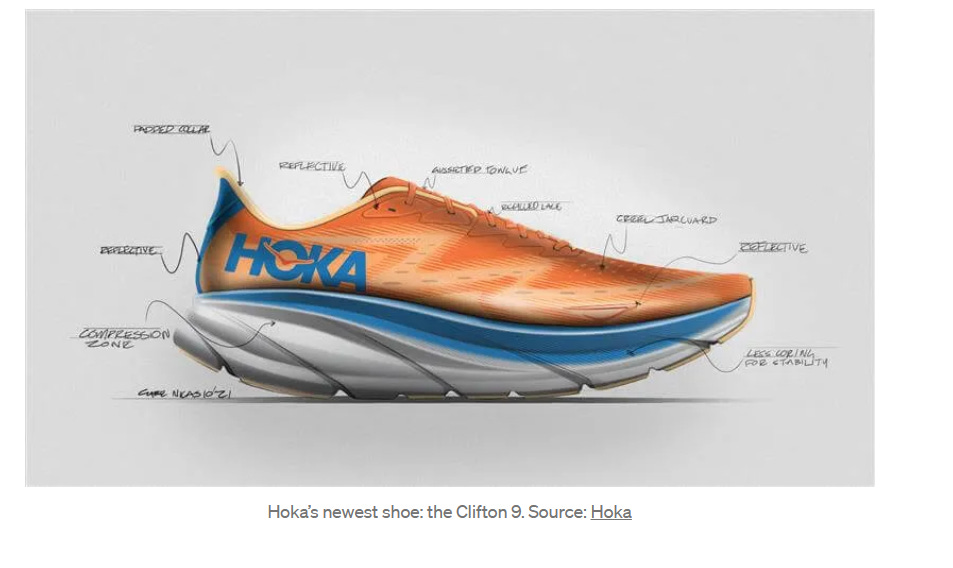

HOKA: VERY QUIETLY BECOMING VERY RELEVANT

When Deckers bought Hoka in 2012, the brand had just over $2 million in sales. Nobody outside of elite runners had heard of it.

Hoka, with its with its bulky appearance and oversized outsoles, was an outlier in athletic shoe stores filled with lightweight and slim sneakers influenced by the leading apparel companies.

Hoka sales amounted to less than 10% of Deckers’ revenues only five years ago. Now in 2023, they account for nearly 40%.

With Hoka’s selective distribution keeping supply below demand and maintaining the premium appeal of sneakers that generally cost between $125 and $175.

Hoka’s executives are pacing themselves, cautious about getting too big too soon, betting that trying to win every consumer is how a company loses its identity. They are running the business as if they are running a marathon.

They say there are three key elements of Hokas—the midsole (for soft landings), the foot frame (for support) and the curved sole called a meta-rocker (for propulsion)—and the combination of stability, efficiency and cushioning helps prevent injuries and alleviate pain.

It took five years for Hoka’s sales to accelerate from less than $3 million to more than $100 million. It took six more to zoom past $1 billion.

The company has only 440 individual unique shoes for men and women in different colors and widths. (A Harvard project estimated that Nike has 10,000.) Somehow, though, the shoes have crossed into the mainstream.

Hoka started as a solution to a problem. French mountain runners Nicolas Mermoud and Jean-Luc Diard aimed to create a shoe cover that would help them run downhill faster. The idea was that runners would carry the covers up mountains and slip them on for steep downhill runs.

“People thought they looked like clown shoes, but I didn’t care…I could float over rocks and not feel anything.”

— Karl Meltzer (famous runner)

“The fact is brands that have experienced explosive growth have, almost without exception, had some type of visually arresting quality to them. Reebok’s aerobic shoes didn’t look like any other shoe. Teva, Keen, Ugg, Dr. Martens, Vibram FiveFingers — these were all shoes that when they hit the market consumers said, “Wow, that’s different.”

- Jim Van Dyne (ex-brand president)

Great brands are not just the result of strong marketing, but a company operating model that connects brand and product to underlying operations. Hoka is just trying to be Hoka, just like Ugg is always trying to be the same product since the 1970s, even when this brands partner with others, they are always making sure that the product does not change much.

Wendy Yang (ex-president of performance lifestyle) believes Hoka’s ability to develop a results-driven, consumer-informed but also brand-led culture has been instrumental to Hoka’s fast success.

She elaborated, “I think that’s really important because the consumer wants to be led. So you listen to the consumer, be very consumer informed, but then be brand-led…It’s nuanced, but it’s quite important.”

“Hoka’s unique sole has gone from a hurdle (Why would I wear those clown shoes?) to key brand asset (Oh, are those Hokas?). By leaning into its distinctive brand assets, Hoka now has a base (or sole?) on which to take on industry giants like Nike. Their operations are also designed to keep producing standout products. I wouldn’t bet against them.” - Michele Wiles

Whenever you have a superior product, word of mouth can be your biggest friend.

HOKAs have been blowing up social media for the past couple of years, and even Harry Styles has gotten in on the shoes’ game, with a buzzy Instagram photo earlier this year proudly showing off the TikTok-fave HOKAs on his feet.

The international expansion is still in the early innings and brand awareness, while making strong inroads, still has a significant amount of growth ahead. That’s the kind of story that excites any investor, when you are looking for undiscovered brands and strong growth that’s not well understood by the street.

Hoka should reach about $1.2-$1.4 billion in sales which is a remarkable accomplishment considering fiscal 2018 sales were $153.5 million for a compound annual growth rate of roughly 50%.

Hoka is taking meaningful market share at the lower end of the annual sales peer group and Under Armour, Skechers, Asics, and New Balance are likely feeling the pinch the most.

Although performance is its bread and butter, Hoka has also made inroads with the fashion-focused consumer.

“They’re no longer just valued as an athletic footwear brand, thanks to TikTok and celebrity influence, they’re really resonating within streetwear, too”

Ugg has had a similar trajectory. It started as being associated with cozy winter wear and has become a fashionable staple, as well as expanded into home with blankets and pillows.

Both Hoka and Ugg are higher-ticket items that have managed to secure sales in a moment of historic inflation. Hoka running shoes start at around $125 and the classic tall Ugg sheepskin boot goes for $200. Both brands have a reputation for quality that may speak to consumers looking to invest in a well-made product.

If you look at what consumers want in this moment, they want strong communication and value, and it seems like Decker Brands continues to communicate value well to the consumer and justify their price points for it.

For example, secondary market platform StockX — a destination for sneakerheads — revealed in January that Hoka was its second-fastest-growing sneaker brand, experiencing 713% trade growth over the past year.

What we can learn as consumer brands investors from Deckers Brands ?

Positioning counts, when Deckers acquired Ugg from Smith, it moved Ugg away from its sporty roots, inking partnerships with retailers like Nordstrom and Neiman Marcus. Today its shoes are placed on shelves inches away from brands like Prada.

"Ugg has a big presence in department stores, but not just any department store," "Shoppers actually see them as high-end because they are situated near brands that shoppers talk about, season after season."

Dave Powers, says the brand works hard to maintain the perception of luxury by being extremely selective with its retail partners. "Not just anyone can sell the Ugg brand," he says. "We're pretty strict about who we allow to sell our product. The pricing, the placement, the distribution is all strategic. We've had key, independent accounts over the years, which is why you might see kiosk stores in New York City selling Ugg boots, but mostly we sell in boutiques and high-end department stores."

Ugg's longevity doesn't come from a fashion moment. It's seeped in a tradition of product expertise, and that's helped them leverage their brand equity across all categories," some branding experts say. "Ugg has a rare staying power. They hold a place in the shoe market that no one else seems to come near."

The same can be said of Hoka, the love for this brand is just unbelievable. Yes, running is critical. That is always going to be their epicenter, and then trail and hike, they are authentic in those categories. But beyond that, the adoption across all demographics, in fashion and performance — that’s where they wiil see some lasting opportunity.

That’s why Nike is so big, right? That’s why Adidas is so big. They’ve been able to strike that balance with global consumers.

‘‘ For Hoka, customers don’t just like the brand because of how it looks; they love the brand because of what it does for them.”

In June of 2022, Hoka revealed its first-ever global brand campaign, dubbed “Fly Human Fly” along with new running shoe, the Mach 5.

Deckers said 83% of visitors on the Fly Human Fly landing page on HOKA.com were new visitors, in line with the company’s goal to broaden the running brand’s reach to new consumers. Powers said he sees a huge opportunity to expand into hiking, walking and lifestyle lanes. He also highlighted opportunities to reach consumers at wholesale channels such as Foot Locker.

“We’re starting to hear comments about people are trading their all white Nikes for all white Hokas, Powers said. “And so that’s very encouraging for us as well.”

Hoka also plans to expand its own retail footprint to reach new consumers as well. The brand plans to open its first permanent retail store in New York City in the spring of 2023 and another pop-up in the city as well.

They’re seeing massive interest in younger fashion consumers in China and in Europe that haven’t seen in the past. The opportunity now is connecting with this younger consumer who craves the brand and sees it as a fashion staple.

Let’s finish with some important words from the CEO about the culture of the company:

“You stick at it, you stay true to your convictions, you stay true to your beliefs and you just work at it and it’s amazing what can happen,” said Powers.

“I care about our employees as I care about my family and I think that happens a lot in our company, we really care about each other. To me, that’s the enduring side of Deckers that is most special.”

If you liked this article, please don’t forget to press the like button and consider becoming a paying subscriber, you'll gain exclusive access to my entire catalog, receive additional weekly articles to fuel your knowledge, access many insider details, and engage with a passionate community of fellow enthusiasts.